In the heat of summer, we often don’t think about preparing our homes for cold weather or upgrading our furnaces. But right now is actually the very best time to be planning these home improvement projects. This is thanks in large part to the Inflation Reduction Act.

The Inflation Reduction Act (IRA) is one of the biggest topics of conversation for everyone working in climate, energy, and home improvement these days. (If you haven’t heard much about it yet, start by checking out our March blog on the basics of the IRA.) As a recap, the IRA is the largest piece of climate legislation in US history, and it has the potential to have enormous impacts for energy costs, pollution, and climate change across the country. Through this huge investment, the federal government will be providing funding to energy efficiency projects and programs, as well as providing funding directly to households, homeowners and renters alike.

IRA funding is not available yet. But people are already preparing to make the most of the funding. Manufacturers are preparing to sell IRA-approved products, contractors are preparing to install them, and nonprofits like Ecolibrium3 are preparing to help residents make informed decisions.

How can you make the most of these incentives where you live? Here are some ways to start getting ready:

1. Learn about the basics of home energy efficiency.

When people think of home energy use, they often think of something like installing new windows, putting in a solar array, or adding new insulation. Yes, these are valuable steps in improving your home energy system, but there are simpler, less time-intensive steps to start with. These simpler steps often give quicker returns on investment and some are required before taking others.

Those “drafty” windows, for instance, may not be the real issue. It might really be the large gaps around the windows that you could easily seal for a much lower cost. Or, if you’re looking to add solar to your roof, you should make sure that you have lowered your electricity needs first, so the energy produced is not wasted. Swapping in LED light bulbs or upgrading appliances are great options to do so.

2. Think about what changes you’d like to make in your home.

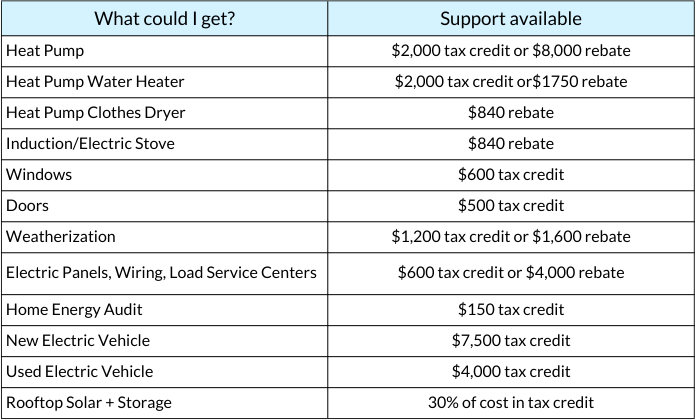

The IRA is one tool you can use to make your home more comfortable, healthy, and energy-efficient. IRA incentives can help you swap out your old heating system for a brand new heat pump, which provides both heating and air conditioning. It can help replace smaller appliances, like your stove or dryer with models that use less energy. It can help you make substantial changes to the building by adding insulation, installing new windows and doors, and upgrading your electrical system. There are many things that can be purchased and installed in your home with IRA money. For a full list of eligible activities and amounts, see the chart below.

If you’re thinking, “what the heck is a heat pump anyway?”, or aren’t familiar with any of the other activities listed, look out for our future posts. We’re going to be breaking down some of the big actions you can take to improve the energy efficiency of your home, how it can be paid for (IRA), and how it can help you have a more comfortable, healthy, and efficient home.

3. Learn about how funding will be available under the IRA.

Funding is made available to residents under the IRA in two main ways: tax credits and rebates. Tax credits are used to make your income taxes lower. For example, if you qualify for a $200 tax credit, you would pay $200 less in income tax that year. Tax credits apply after your spring tax submission. A rebate, on the other hand, is a partial (or full) refund you can get after you buy something. For example, maybe you buy a $1200 appliance, and you qualify for a $800 rebate. You would end up only spending $400 on the appliance because of the rebate. It is not yet clear how long it will take to receive a rebate after a purchase, but you will not have to wait until tax season. Many cases may result in a point-of-sale rebate.

Think about your finances and what might work best for you. If you pay higher income taxes, and you can wait to see a return on your investment, a tax credit could be very helpful. If your income taxes are lower, or if you need a quicker return on your investment, focusing on rebates might be a better fit. Learning about these options now will help you decide what to focus on when IRA funding is announced.

*It is important to note that any applicable work you do at this moment may only be claimed as a tax credit, not a rebate. If you wish to receive a rebate, wait until the program is fully administered by the state.

4. Explore other incentives for home upgrades.

The Minnesota State Legislature passed exciting legislation this year to support home energy efficiency and electrification. This includes funding for air-source heat pumps, electric panel upgrades, electric vehicles, and more. It even includes tax credits for electric bikes, which is not included in the IRA.

The first step to make any home more energy-efficient and comfortable is to get an energy audit. In our free standard home energy audit, we check your heating system, meter your appliances to see how efficiently they run, provide counseling on your utility bills, and install energy-saving fixtures, like LEDs. Our advanced audit, which is also free for income-eligible households, provides a better understanding of the building envelope. Here, we test how leaky the building is and identify areas of greatest energy loss. Either audit will bring the expertise of our energy auditor into your home to provide you with proper information to plan your home energy journey and prepare for coming funds.